If you have ever checked your credit report and noticed multiple loan or credit card inquiries, you may have wondered…

Alternative Credit Score: Fintech Is Changing Credit Evaluation

For many years, loan approvals in India were largely dependent on the credit score provided by traditional credit bureaus. If…

Why Credit Score Decrease? Top Reasons and Ways to Fix It

Have you ever accessed your credit report and wondered, why credit score decrease when I am paying my EMIs on…

Credit Score for Home Loan: Can You Apply with a Low Score?

When you apply for a home loan, lenders don’t only check your income; they check your financial habits. And that’s…

Good Credit Score for Personal Loan: How Much Is Enough?

When applying for a personal loan, one thing that always comes up is the question: how much credit score is…

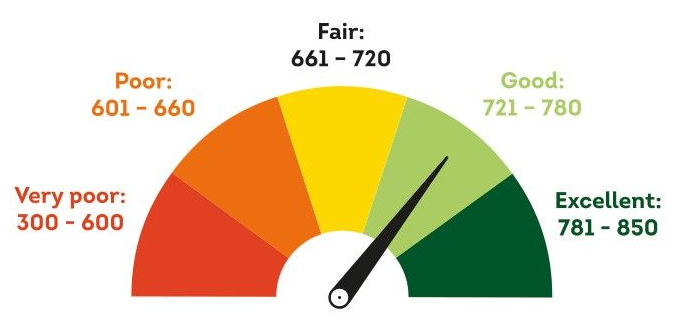

Understand The Credit Score Categories In India

Many people check their credit score but do not understand what it actually means. You might see a number like…

Get Free Credit Score in India: A Simple Step-by-Step Guide

In today’s financial generation, your credit score is an integral part of your financial condition. Whether you are applying for…

What Is the Minimum Credit Score for Car Loan Approval in India?

Purchasing a car is a significant financial transaction. Although your income and employment status are important, your credit score for…

Understand When Do Credit Scores Update in India

Many borrowers track their credit score closely, especially after paying EMIs or clearing credit card dues. But one common question…

The Real Advantages of a Good Credit Score in India

When it comes to personal finance, the importance of credit scores cannot be overstated. Most people believe that credit scores…