When you’re planning to borrow, selecting the best option for a personal loan is essential. In India, personal loans are widely available, but not all loan options fit your financial situation. This blog explains how to compare different personal loan offers, assess eligibility, and discover the best personal loan in India for your needs. Whether you’re borrowing for medical expenses, travel, or home improvement, knowing how to choose wisely helps you avoid high-interest rates and hidden fees.

Why Finding the Best Option for a Personal Loan Matters

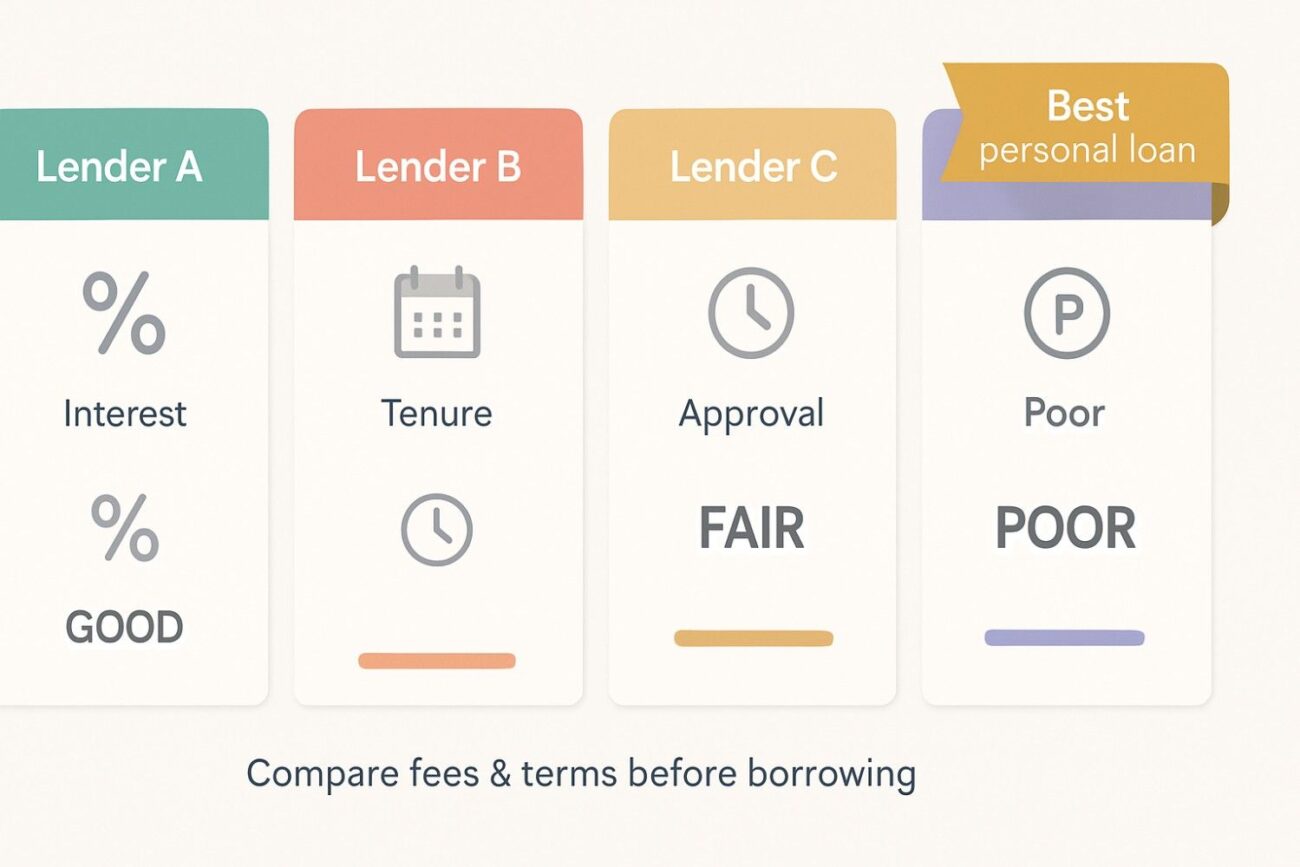

Choosing the best option for a personal loan can save you money in the long term. Many borrowers pick a loan based on ease of approval or fast disbursal without considering interest rates, tenure, and processing fees. With rising loan offers, it’s more important than ever to understand your options.

Key factors to compare:

- Interest rate

- Loan amount eligibility

- Processing time

- Documentation requirements

- Repayment tenure

By evaluating these factors, you can select the best personal loan in India tailored to your income and repayment capacity.

Important Features to Compare When Looking for the Best Personal Loan in India

| Feature | Why It Matters | What to Look For |

| Interest rate | Affects the total repayment amount | Lower rates save you money |

| Loan amount | Covers your financial needs | Ensure it’s sufficient but manageable |

| Tenure | Repayment flexibility | Choose one that aligns with your EMI affordability |

| Processing time | Affects emergency needs | Faster disbursal options are better in urgent cases |

| Documentation | Simplifies the process | Minimal paperwork with clear eligibility criteria |

How to Compare Personal Loan Options and Pick the Best Option for a Personal Loan

1. Assess your borrowing purpose

Different lenders offer tailored products for medical expenses, education, travel, or debt consolidation. Define why you need the loan to pick the right plan.

2. Check the interest rate structure

Compare fixed and floating interest rates. Even a 1% difference can save thousands over the loan term.

3. Review eligibility criteria

Some lenders approve loans based on salary, employment type, or credit score. If your income is lower, options like Olyv, which facilitate personal loans with flexible eligibility criteria, can be a reliable choice.

4. Understand processing and hidden charges

Look for processing fees, prepayment penalties, or documentation costs. Transparent lenders highlight these upfront.

5. Compare repayment tenure options

Longer tenures reduce EMI but increase total interest. Shorter terms cost more monthly but save interest payments.

Example: Choosing the Best Option for a Personal Loan Based on Income

| Borrower Type | Monthly Income | Loan Amount Needed | Suitable Option |

| Salaried person | ₹30,000 | ₹2,00,000 | Best personal loan in India with low processing fees and fixed EMI |

| Self-employed | ₹25,000 | ₹1,50,000 | Loan with flexible eligibility and minimal documentation |

| Retired | ₹20,000 | ₹50,000 | Short tenure loan with faster disbursal option |

How Olyv Helps You Choose the Best Option for a Personal Loan

Olyv’s platform offers tailored solutions that help you compare multiple lenders without the hassle. You can easily check eligibility, select the right loan amount, and apply online. With transparent interest rates and repayment schedules, you’re empowered to pick the best option for a personal loan that suits your financial situation.

FAQs – How to Find the Best Personal Loan in India

Q1: How can I find the best option for a personal loan with a low income?

You can check lenders that offer flexible eligibility and provide loans based on bank statements instead of fixed salaries. Olyv’s solutions are ideal for borrowers with a personal loan for a 20,000 salary.

Q2: Why is comparing interest rates important while selecting the best personal loan in India?

Even small differences in rates can lead to higher repayment amounts. Comparing helps you avoid loans with hidden charges.

Q3: How to check the status of your personal loan application?

You can log into the official portal provided by Olyv and track your application status easily, ensuring transparency and control.

Q4: What are the common mistakes when selecting the best option for a personal loan?

Borrowers often pick loans without reviewing the full cost of borrowing or tenure options. It’s crucial to compare multiple lenders and read terms carefully.

Q5: How long does it take to get approval for the best personal loan in India?

Depending on your documents and eligibility, loans through platforms like Olyv can be processed within a few hours.

Final Thoughts

Choosing the best option for a personal loan is more than just picking the first offer you see. By comparing rates, tenure, eligibility, and repayment plans, you can find the best personal loan in India that fits your lifestyle. Olyv’s tools make this process simple and transparent, ensuring you get the right loan without unnecessary stress.

Start your loan journey with Olyv today and take control of your finances.