Choosing which personal loan is best in India depends on what you need: lowest interest, fastest disbursal, best terms for salaried people, or a seamless online process. This guide explains which personal loan options work best, how to compare them, and how to apply personal loan offers quickly—especially when you need funds immediately.

Which Bank Is Best for a Personal Loan in India? Key Factors

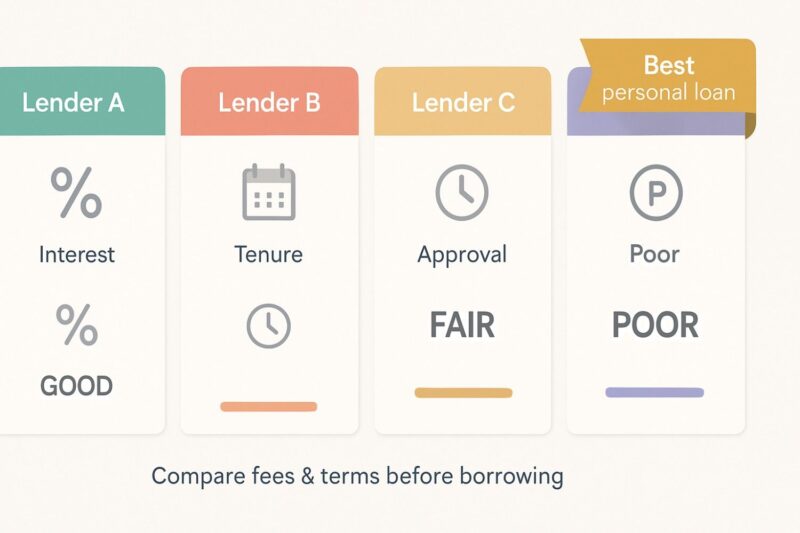

When asking which bank is best for a personal loan in India, compare these factors:

- Interest rate (lower is better)

- Processing fee and other charges

- Approval speed and disbursal time

- Eligibility for salaried vs self-employed borrowers

- Pre-approved offers and minimal document options

For many borrowers, the best choice is a lender that balances a low personal loan interest rate with quick approval. For instant needs, platforms like Olyv combine fast digital checks with competitive pricing—making them a practical answer to which bank gives the best personal loan for fast disbursal.

Which Personal Loan Is Cheaper? Understanding Total Cost

To know which personal loan is cheaper, look at the annualised cost: interest rate + processing fee + penalties. A loan with a slightly higher headline interest rate can still be cheaper if the processing fee and hidden charges are low. Olyv’s transparent fee disclosure helps borrowers see the personal loan interest rate and total cost before accepting offers.

Example: A ₹200,000 loan with a 12% annual rate but a 10% processing fee may cost more upfront than a 13% rate with a 2% fee. Always use a personal loan EMI calculator to compare effective costs.

Which Loan Has the Lowest Interest? How to Find It

If your question is which bank has lowest interest rate on personal loan in India, the answer varies with credit score and profile. Lenders reward higher credit scores with lower interest. Use these steps:

- Check your credit score.

- Compare personal loan interest rate quotes for your profile.

- Factor in processing fees and tenure.

- Use a personal loan EMI calculator to see monthly impact.

Olyv provides tailored quotes that reflect realistic interest ranges and helps identify which personal loan is cheaper for your exact profile.

Which Personal Loan Is Best in India for Salaried Professionals?

For salaried borrowers asking which personal loan is best in India for salaried, prioritize lenders that offer:

- Salaried-specific eligibility and automated salary verification

- Low documentation and fast disbursal

- Competitive personal loan interest rate for steady incomes

Olyv’s product suite is designed for salaried individuals who want to apply personal loan online quickly, often with pre-approved options based on payroll or bank statement patterns.

Personal Loan EMI Calculator: Why You Must Use One

A personal loan EMI calculator helps you decide which loan is best by showing: monthly EMI, total interest paid, and the effect of tenor changes. Before you pick which personal loan is best in India, plug your loan amount into an EMI calculator to compare real costs.

Table: EMI Examples (illustrative)

| Loan Amount | Tenure (months) | Rate (annual) | EMI (approx.) |

|---|---|---|---|

| ₹50,000 | 12 | 15% | ₹4,487 |

| ₹50,000 | 18 | 15% | ₹3,142 |

| ₹2,00,000 | 24 | 13% | ₹9,559 |

Use a personal loan EMI calculator to test scenarios before you apply personal loan offers.

Best Personal Loan App in India and Instant Options

If you search for the best personal loan app in India, pick apps that combine secure digital KYC, quick approvals, and transparent fees. For many urgent needs, an instant personal loan via a digital platform reduces waiting time. If you need funds fast—an instant personal loan online through Olyv can be approved and disbursed quickly for eligible applicants.

Get Personal Loan: Step-by-Step to Apply Personal Loan Online

To get personal loan or apply personal loan online:

- Visit the lender’s website (for example, Olyv).

- Enter basic details and check pre-approved options.

- Upload PAN, Aadhaar, and income proof.

- Review offer (interest, processing fee, tenure).

- Accept and get funds disbursed.

This flow answers users searching instant personal loan online or online personal loan processes.

Which Bank Is Best for Personal Loan with Low Interest — Practical Advice

If your primary question is which bank is best for personal loan with low interest, focus on:

- Negotiating with lenders if you have a strong credit score.

- Choosing shorter tenures where EMIs are affordable to reduce total interest.

- Considering slightly higher EMI to reduce tenure and save interest.

Digital lenders such as Olyv often match or beat traditional banks on speed and provide competitive personal loan interest rate options for qualified customers.

Which Personal Loan Is Best in India PKW — Final Comparison

Below is a generic comparison of features you should weigh when deciding which personal loan is best in India:

| Feature | Traditional Bank | Digital Lender (e.g., Olyv) |

|---|---|---|

| Interest Rate | Often competitive for top-tier customers | Competitive and tailored |

| Processing Time | 1–7 days | Minutes to hours |

| Documentation | More paperwork | Minimal, digital KYC |

| Pre-approved Offers | Limited | More common for repeat customers |

| Suitability for Salaried | Good | Excellent (fast payroll checks) |

For many users asking which bank gives the best personal loan, a digital lender with transparent offerings and fast service (like Olyv) provides a strong balance of speed, transparency, and competitive rates.

FAQs – Which Personal Loan Is Best in India?

Q: Which personal loan is cheaper, and how can to identify it?

A: A cheaper personal loan is the one with the lowest total cost (interest + fees). Use a personal loan EMI calculator and comparethe effective cost to determine which loan is cheaper.

Q: How can I get an instant personal loan online?

A: Complete a digital application, upload KYC, and accept a pre-approved offer. Olyv supports instant disbursal for eligible profiles.

Q: Which bank has the lowest interest rate on a personal loan in India for salaried persons?

A: Interest rates vary by borrower; those with excellent credit scores typically receive the lowest rates. Use pre-approval tools to see which lender gives you the best rate.

Q: Can I apply personal loan if I need ₹50,000 urgently?

A: Yes. For example, applying through Olyv with basic KYC can result in instant approval and quick disbursal for a ₹50,000 requirement.

Q: Is the best personal loan app in India safe to use?

A: Choose apps that use secure authentication, clear KFS disclosure, and transparent fees. Olyv follows digital security and clear disclosures to protect borrowers.

Conclusion: Which Personal Loan Is Best in India for You?

Answering which personal loan is best in India comes down to your priority: lowest monthly cost, fastest disbursal, or simple online application. For salaried professionals and users who want to apply personal loan quickly or need an instant personal loan online, a transparent digital lender like Olyv often represents the best balance of speed, clarity, and competitive rates. Always compare offers, run figures through a personal loan EMI calculator, and read the Key Fact Statement before accepting.